Vietnamese Electric Vehicle Company VinFast Soars 109%: Market Cap at $85.3 Billion, Speculation Outweighs Substance

5 min read

Vietnamese electric vehicle company VinFast Auto has experienced another significant surge in its stock price. VinFast closed at $36.72 per share, marking a surge of 108.87% from the previous day. With this closing price, the company’s market capitalization stands at $85.272 billion. VinFast is Vietnam’s largest publicly-listed company in the U.S. and holds the distinction of being the largest listing in the U.S. market in 2023 thus far. However, VinFast’s stock price in the U.S. market resembles a roller coaster ride.

VinFast opened at $22 on its first day of trading, closing at $37.06, a remarkable increase of 254.64% from its initial offering price. Based on the closing price, VinFast’s market value soared to $86 billion. Subsequently, VinFast’s stock price experienced a continuous decline over three days before soaring again today. In the capital market, VinFast seems to be driven more by speculation than actual substance, as its performance hardly justifies its $85.272 billion valuation.

This is attributed to the fact that VinFast’s revenue falls significantly short when compared to Chinese electric vehicle startups such as NIO, XPeng Motors, and Li Auto. VinFast’s delivery volume also pales in comparison to its Chinese counterparts. Investors have even remarked that the valuation appears to be inflated.

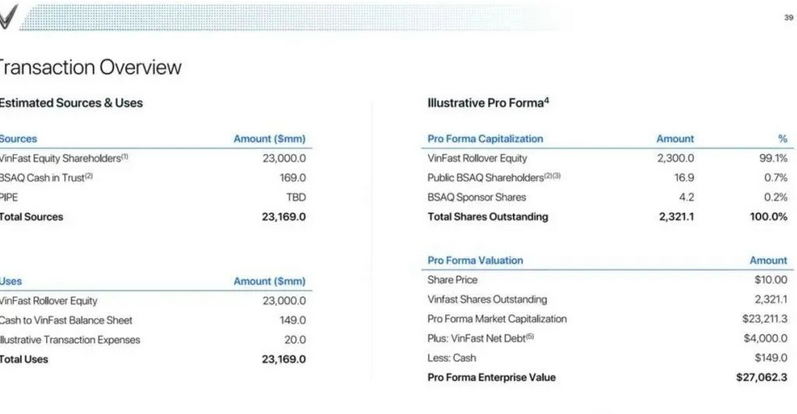

VinFast went public through a merger with special purpose acquisition company (SPAC) Black Spade Acquisition Co (NYSE: BSAQ) and subsequently listed on the NASDAQ in the U.S. Black Spade Acquisition is affiliated with Melco International, and its chairman is Lawrence Ho, the son of casino magnate Stanley Ho.

The merger of companies values VinFast at approximately $27 billion, with an equity value of about $23 billion. This calculation does not include around $169 million in trust cash from BSAQ (assuming no Black Spade shareholders opt to redeem their Black Spade shares and cash is used where permitted). In reality, companies like Lordstown, Nikola, and Faraday Future have seen their market values drop by over 90% since their SPAC mergers. VinFast had also attempted a traditional IPO but was met with a cold reception from the market. Rivian’s market value initially exceeded $150 billion upon listing but has now dropped to under $20 billion.

VinFast, a subsidiary of Vingroup, was established in 2017. It operates in Vietnam, North America, and is soon to produce and export SUVs, electric scooters, and electric buses to Europe. However, over the past two years, VinFast has reported losses amounting to $3.46 billion.

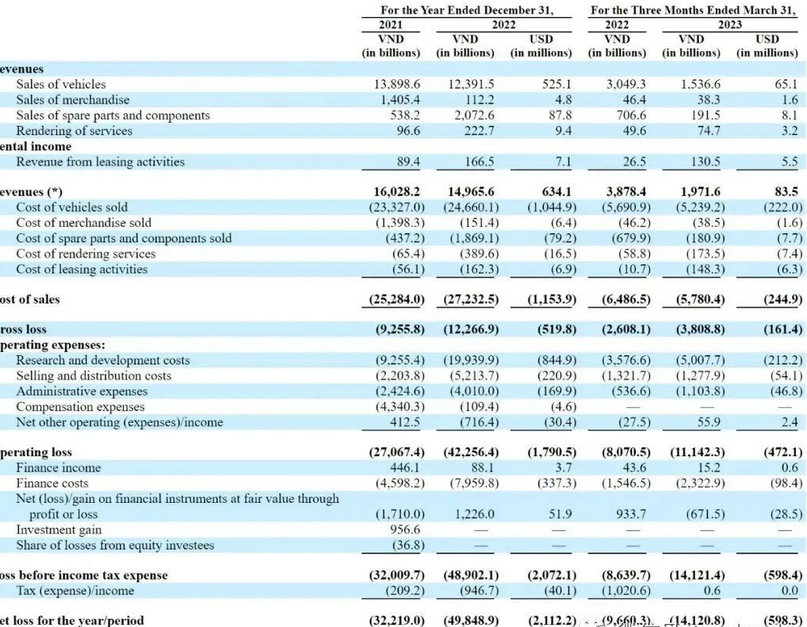

The prospectus reveals that VinFast generated a revenue of $670 million in 2021, with an operational loss of $1.133 billion and a net loss of $1.348 billion. In 2022, VinFast’s revenue was $634 million, accompanied by an operational loss of $1.791 billion and a net loss of $2.112 billion. Overall, VinFast’s vehicles seem to lack a competitive cost-performance ratio, and the company has incurred substantial losses, amounting to a total of $3.46 billion over the course of two years.

In the first quarter of 2023, VinFast reported a revenue of $83.54 million, coupled with an operational loss of $472 million and a net loss of $600 million. In May 2023, VinFast faced challenges as it had to recall all electric SUVs shipped to the United States due to software malfunctions, which garnered negative feedback. Additionally, VinFast implemented layoffs affecting some of its U.S. employees.

VinFast’s CEO, Le Thi Thu Thuy, stated, “There have been some negative comments. We attach great importance to these comments and will reflect on the feedback to make our cars better.” The company’s controlling shareholder is the richest person in Vietnam and is often referred to as the “Vietnamese version of Xu Jiayin,” the chairman of Evergrande Group in China. VinFast’s parent company is Vingroup JSC, Vietnam’s largest private conglomerate. Similar to Chinese companies like Evergrande and Baoneng, Vingroup’s primary business is real estate, and VinFast is just one division within the larger Vingroup conglomerate.

Vingroup JSC’s major shareholder is Pham Nhat Vuong, who is the richest person in Vietnam. VinFast has previously secured $9.3 billion in financing, primarily from Pham Nhat Vuong’s other ventures, to fund its operations and capital expenditures. Pham Nhat Vuong’s life story is quite remarkable: born in Vietnam, he studied in the Soviet Union, settled in Ukraine, and initially gained success by selling instant noodles, becoming known as the “Instant Noodle King” of Ukraine. In 2001, he returned to Vietnam and ventured into the real estate industry.

In 2009, Pham Nhat Vuong sold his Technocom food company in Ukraine to Nestlé and merged his Vincom and Vinpearl businesses, renaming the conglomerate Vingroup JSC. Vingroup JSC’s operations encompass high-end apartment complexes, office buildings, commercial complexes, and large-scale central business district (CBD) developments. They are also involved in hotel and resort development and operation, as well as theme park ventures, dining and entertainment, education, and healthcare services. His success in the real estate sector has earned him the nickname “Vietnamese Xu Jiayin,” drawing parallels to the chairman of Evergrande Group in China.

At the end of October 2022, Zeng Yuqun, the Chairman of CATL (Contemporary Amperex Technology Co., Ltd.), also flew to Osaka, Japan, where he met with Pham Nhat Vuong. Unlike figures like Xu Jiayin and Yao Zhenhua, Pham Nhat Vuong eventually realized the mass production of VinFast electric vehicles. However, VinFast has consistently relied on the financial support of its parent company. In April 2023, Pham Nhat Vuong raised an additional $2.5 billion for VinFast, with $1 billion coming from his personal funds. VinFast’s market valuation had once surged to $86 billion, surpassing Volkswagen, BMW, and Mercedes-Benz, and closely trailing BYD, making it the fifth-largest publicly traded automaker globally. This in itself is ironic.

Back in the day, Evergrande Auto was also briefly valued at over HKD 500 billion in the capital market. In September 2020, it introduced several renowned international investors, including Tencent, Sequoia Capital, Yunfeng Fund, and Didi Chuxing, through a “old-for-new” arrangement, raising about HKD 4 billion. In January 2021, Evergrande Auto conducted a private placement of 952 million new shares to six investors, raising a total of HKD 26 billion and valuing the company at over HKD 400 billion. However, today, Evergrande Auto’s market value stands at only HKD 13.6 billion. Xu Jiayin has “harvested” a group of wealthy investors, and among the strategic investors who suffered significant losses was Hong Kong tycoon Joseph Lau. In 2021, nearly all of the HKD 3 billion investment by Lau’s wife, Chan Hoi-wan (Kam Mi), through a private placement to Evergrande Auto, saw its value evaporate.

Presently, VinFast is not exactly the Vietnamese version of Tesla, but rather possibly the Vietnamese counterpart of Evergrande Auto. Despite the significant market hype, investors who take things at face value may find themselves shedding tears in the future.