Tesla Seems to Be Struggling with Sales?

6 min read

Tesla is finding it increasingly challenging to maintain profitability. The company’s just-released Q3 earnings report shows a decline in its financial performance compared to the same period last year.

Specifically, due to pressures from falling car prices and rising costs, Tesla’s revenue and profit indicators have dipped. Total revenue is down 9% YoY at $23.4 billion, gross profit decreased by 22% to $4.18 billion, and GAAP net profit dropped over 40% to $1.85 billion.

Tesla attributes the decline in net profit to several factors. One reason is that factory upgrades have reduced production output, leading to a drop in deliveries. Furthermore, Tesla is making significant investments in artificial intelligence and has “activated one of the world’s largest supercomputers,” doubling its computing capabilities from the previous quarter.

In terms of cash flow, Tesla’s operating cash flow for this quarter is $3.3 billion, down 35% YoY, while free cash flow is $848 million, down 74%. Cash balance at the end of the quarter increased by $3 billion to reach $26.1 billion compared to the previous quarter.

Let’s turn to vehicle deliveries.

In the quarter, Tesla produced over 430,000 vehicles worldwide and delivered over 435,000 vehicles. This included nearly 16,000 Model S and Model X deliveries and nearly 420,000 Model 3 and Model Y deliveries.

It’s evident that despite significant price reductions, sales of Model S and Model X are still declining (2Q sales were nearly 19,000 units). The absence of physical shifters and ultrasonic sensors might have contributed to this decline, but the root cause seems to be a lack of focus from Tesla on its high-end product line, the S and X.

For Model 3 and Model Y, deliveries slightly dropped due to a generational hiatus for Model 3. Looking forward, with the introduction of the new Model 3 and Cybertruck deliveries in Q4, Tesla anticipates that it will still exceed its 2023 full-year delivery target of over 1.8 million units, which remains higher than the 50% compounded annual growth goal.

*Just before publishing, Tesla China officially launched the refreshed Model 3 for sale, with a rear-wheel-drive version priced at $25,990 and a long-range all-wheel-drive version at $29,550.

Digging Tunnels with a Spoon

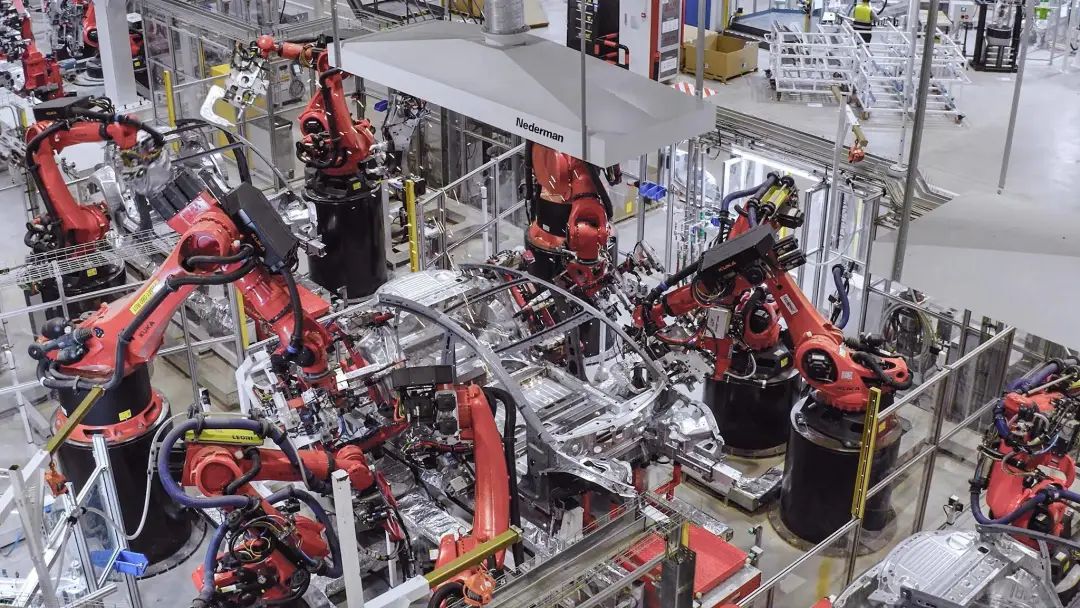

Elon Musk mentioned in this morning’s earnings call that Tesla is further reducing manufacturing costs through improvements in engineering design, supply chain optimization, and enhanced production efficiency.

In a high-interest-rate environment, focusing on research and development investments for future growth while maintaining positive free cash flow is considered the right approach.

Musk emphasized that reducing vehicle production costs remains Tesla’s top priority. Over a period, the company has been conducting a relentless cost-cutting process, meticulously scrutinizing each expense to save every fraction of a cent on components. In Q3, Tesla’s cost per vehicle dropped to $37,500.

“It’s like digging a tunnel with a spoon,” Musk said.

Even though Tesla has pushed cost-cutting to its limits, in this quarter, the company’s total gross margin is only 17.9%, falling below analysts’ expectations of 18%. With continual price reductions, Tesla’s once-proud gross margin has dropped to a more average level, which isn’t favorable for investors.

On the other hand, today’s Tesla has lost the ability to control gross margins by raising prices.

Aside from intensifying market competition, rising interest rates and inflation have also placed significant pressure on Tesla. Maintaining the affordability of electric vehicles is a significant challenge for the company.

Elon Musk emphasized in the earnings call that for most consumers, the size of monthly payments is a crucial factor in purchasing a vehicle. However, as interest rates rise, consumers’ monthly payment burdens also increase, which has already had a negative impact on Model 3 sales.

In response, Tesla can only continue to reduce prices.

Factories and Eco Havens

Regarding capacity expansion, Tesla is increasing its production scale in Texas and Berlin to meet growing market demands. But Musk also mentioned the need for cautious consideration of the overall macroeconomic environment to avoid blind expansion.

The Cybertruck, set for delivery on November 30th this year, is being produced by the Texas factory, which already has four production lines in place. Musk stated that transitioning from prototype cars to mass production for the Cybertruck has been extremely challenging.

Musk believes that mass production is 10,000% harder than building prototype cars.

Talent and infrastructure development are also potential bottlenecks for Tesla’s growth, with talent shortages and housing constraints emerging in the Texas area due to Tesla’s capacity expansion. Musk mentioned that Tesla needs to overcome these issues for long-term development.

It’s worth noting that Tesla currently occupies only a small portion of the land at the Texas factory, which still has significant room for development.

Before the Q3 earnings report was released, Tesla had already announced an investment of $5.8 billion in the Texas factory, employing over 12,000 staff and paying over $640 million in taxes. Tesla’s investment in the factory will exceed $10 billion before it’s fully built.

However, not all this money is going into manufacturing cars. Tesla has also revealed a plan to plant trees. Yes, even electric car companies must focus on environmental sustainability. They plan to build an “ecosystem paradise” on nearly 50 hectares of land, which is roughly equivalent to 71 standard soccer fields. This “paradise” will include boardwalks, hiking trails, bike paths, streams, thousands of trees and plants, and the removal of invasive species. Tesla will also create a 12-hectare “shallow water habitat” to improve the soil.

Using AI to Dominate

I’ll say it again, Tesla has one of the best artificial intelligence teams on Earth, and they are only getting better.

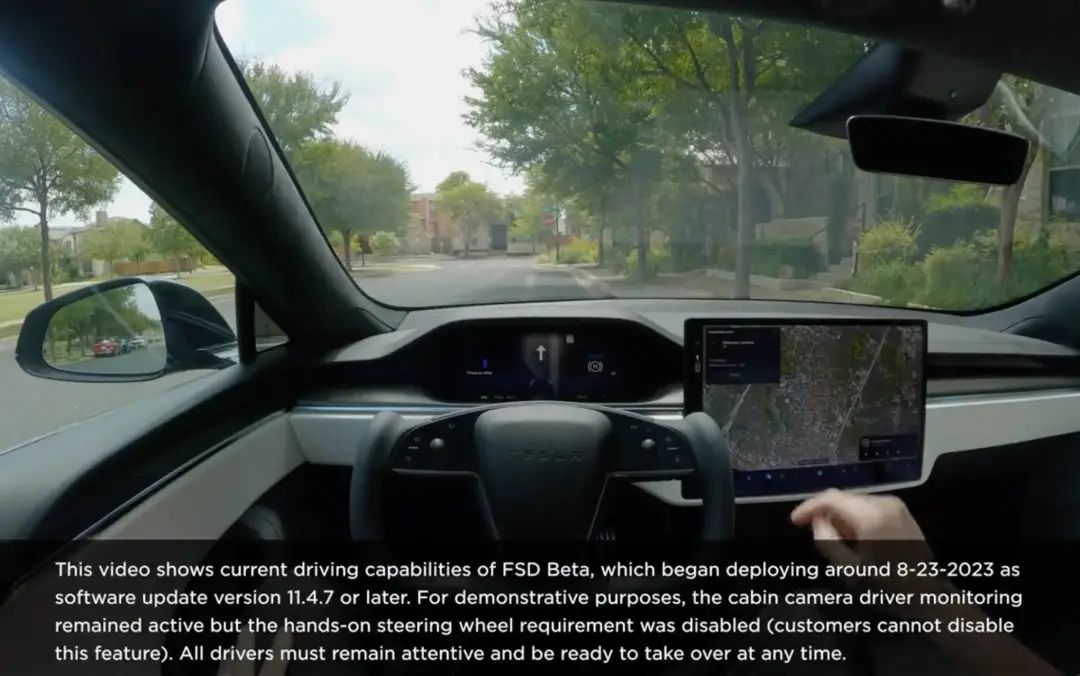

Elon Musk believes Tesla has a significant advantage in artificial intelligence, particularly in two areas: autonomous driving and robotics. Tesla recently released a demo video of FSD Beta V12, which showcased the point-to-point commuting capability of FSD on actual roads in Austin, and there were no surprises in the video.

Unlike in the past, today’s Full Self-Driving (FSD) capability is achieved through visual neural networks, allowing it to perceive and understand the world “like a human,” as described by Tesla. FSD is moving toward end-to-end artificial intelligence rather than relying on traditional software logic.

“We are able to collect anonymous data from vehicles on the road, meaning the neural networks learn from orders of magnitude more miles driven than the average human driver, including some unusual scenarios,” according to Tesla’s Q3 earnings report, which revealed that FSD Beta has accumulated 840 million miles in testing.

It’s said that wisdom comes from learning from one’s mistakes, and Tesla is feeding FSD with failures time and time again.

On the other hand, thanks to the exponential increase in computing power for training artificial intelligence, the Optimus robot project has made significant progress. This humanoid robot can now perform more complex movements and actions, including yoga poses.

Musk believes that in the future, Optimus robots can be used for automation on the factory assembly lines, and at some point, “the robots can build robots.” There have been reports suggesting that Tesla plans to deploy some Optimus robots in its factories next year to incorporate them into the production process.

Musk has consistently believed that with artificial intelligence, they can rewrite the rules of the game, much like their Supercharger network.

BMW Group recently announced that by 2025, its pure electric vehicles sold in the United States and Canada will adopt the North American Charging Standard, NACS, which means that BMW, MINI, and Rolls-Royce electric vehicles in the United States and Canada will be able to use designated Tesla Supercharger stations.

If we take a closer look, several brands have joined the NACS charging standard led by Tesla, including Ford, General Motors, Rivian, Volvo, Polestar, Electrify America, Mercedes-Benz, Nissan, Honda, Acura, Jaguar, Hyundai, Kia, BMW, MINI, and Rolls-Royce.

It seems like an attempt to achieve a unified standard in the industry.