Byton’s golden age, how long can it last?

14 min read

Wang Chuanfu shed tears.

This was on August 9th, at the ceremony for the production of the 5 millionth new energy vehicle by Byton. While recalling the 20 years of car manufacturing, Wang Chuanfu, in the midst of commemorating the hardships and difficulties behind the journey to survival, choked up several times.

It’s as if he was holding his breath, needing to prove that his choice was correct. Byton firmly bet on electrification over the past 20 years, cut corners wherever possible, and worked tirelessly. Finally, starting from last year, they entered a period of harvest.

For Byton, today’s glory is a golden “window of opportunity” that they’ve waited for 20 years to arrive. While the outside world celebrates their success, within Byton, there may be more feelings of nervousness. Just like a traveler in the desert who has been thirsty for a long time finally encounters an oasis, they will drink as much as they can and fill all their containers with water.

On the evening of August 28th, Byton released its 2023 first-half performance report, once again proving Wang Chuanfu’s words, “Byton is currently in the best period in its history.” Compared to last year’s first half, revenue grew by 72.7% to reach 260.1 billion yuan. The gross profit margin increased significantly from 13.51% to 18.33% year-on-year, with gross profit rising by 134.4% to reach 47.6 billion yuan. As a result, Byton achieved its best-ever profit performance for the same period, with a net profit attributable to shareholders reaching 11 billion yuan, a year-on-year increase of 204.7%.

Byton, with nearly all aspects growing close to double digits, is outperforming its competitors by a long shot. Even with such affordable prices, Byton’s gross profit margin surpasses that of Tesla. Part of the reason is Tesla’s continuous price reductions and Byton’s entry into the high-end market. However, the main reason is that Byton’s economies of scale have been maximized, allowing them to compress costs and increase gross profit margins while lowering prices for mainstream models.

There is no doubt that Byton has found an effective cost control method by its own means, but there is always a limit to cost reduction. Especially for Byton, as the effects of cost reduction from mass production of cheaper components and labor become increasingly marginal, there will come a point where cost reduction is no longer feasible. Meanwhile, their competitors like Tesla continuously attempt to increase production efficiency through technological breakthroughs, which can result in leaps in cost reduction. On this path, even smaller players like Weilai have the opportunity to overtake Byton.

Just as in Wang Chuanfu’s famous saying, “The major transformation in the automotive industry, electrification is the first half, and intelligence is the second half.” Byton has occupied the largest market share in electrification through its fast and affordable approach. However, as the penetration rate of new energy increases, Byton, which has relied on scale and cheap labor to win, will face greater challenges when striving for intelligence and high-end positioning. Tesla and Weilai, who are trying to improve production efficiency through technological breakthroughs, pose a greater threat.

Byton, at its zenith, must firmly grasp this window of opportunity and prepare for the transformation, otherwise, it may slowly descend the slope.

Lowering prices while increasing profits, how did they do it?

What supports Byton’s current success is its unparalleled sales.

Indeed, their cars sell a lot. From January to July this year, Byton sold 1.518 million new energy vehicles, an increase of 88.81% year-on-year. It’s worth noting that in the first half of the year, the national sales volume of new energy vehicles was 3.747 million, and according to the China Association of Automobile Manufacturers, Byton’s market share in the new energy vehicle sector increased to 33.5%, an increase of 6.5 percentage points from last year. For every three new energy vehicles sold in China, one of them is a Byton.

It took Byton 13 years to go from 0 to 1 million vehicles, one year for the second million, six months for the third million, and just four months for the fourth million. In terms of car production, Byton seems to have taken a continuously accelerating rocket, or in other words, Byton’s sales, production capacity, and prices have formed a flywheel. The more they sell, the larger their production scale, the lower their costs, and the lower their prices, which in turn drives more sales.

In China, more than 90% of cars are priced below 200,000 yuan. However, in the field of new energy, there aren’t many choices for cars priced below 200,000 yuan. Byton’s Dynasty and Ocean series have basically taken up this space. Consumers can buy a decent electric car for the price of a gasoline-powered car. But this year, Byton’s cost-effectiveness has become increasingly prominent. They keep releasing even cheaper versions to conquer the market.

In recent months, Byton first launched the Song Pro DM-i Champion Edition with a guide price of only around 135,800 yuan to 159,800 yuan. Then it released the Tang DM-i Champion Edition and the Han EV Champion Edition, each offering a 10,000 yuan purchase subsidy. According to statistics, up to now, Byton has launched ten Champion Editions for the Dynasty and Ocean sales networks, with prices ranging from 5,000 yuan to 30,000 yuan.

In a price war, both parties often suffer. Even Tesla, which can control the cost of car manufacturing to the limit, saw its gross profit margin drop to around 18% due to continuous price reductions in the second quarter. However, compared to Tesla, Byton’s prices are so low and so thorough that they’ve increased their profit by doubling sales and reducing costs.

In the first half of the year, Byton’s per-vehicle profit was around 8,700 yuan, and the gross profit margin of its cars further increased to 20.67%. It’s already a difficult task for Ideal, which has a higher selling price, to surpass Tesla in terms of gross profit margin, while Byton, with such low prices, managed to exceed Tesla in terms of gross profit margin. It seems impossible.

The reason lies not only in the lower prices of lithium carbonate, a raw material for batteries, and the increase in profits brought about by cost reductions from the Champion Edition products. The bigger secret is that Byton has taken its scale advantage to the extreme.

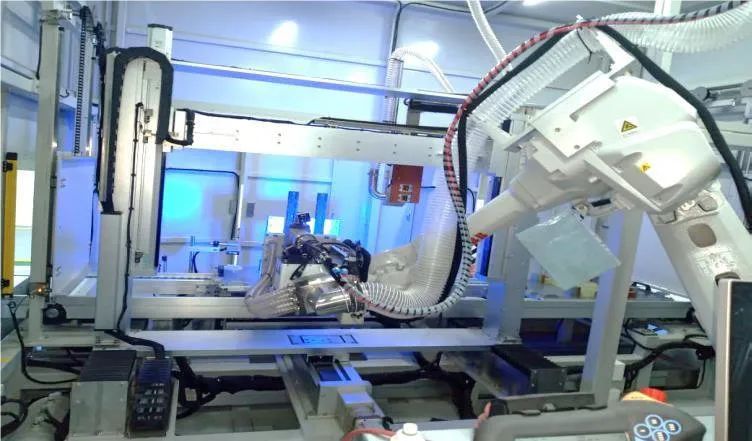

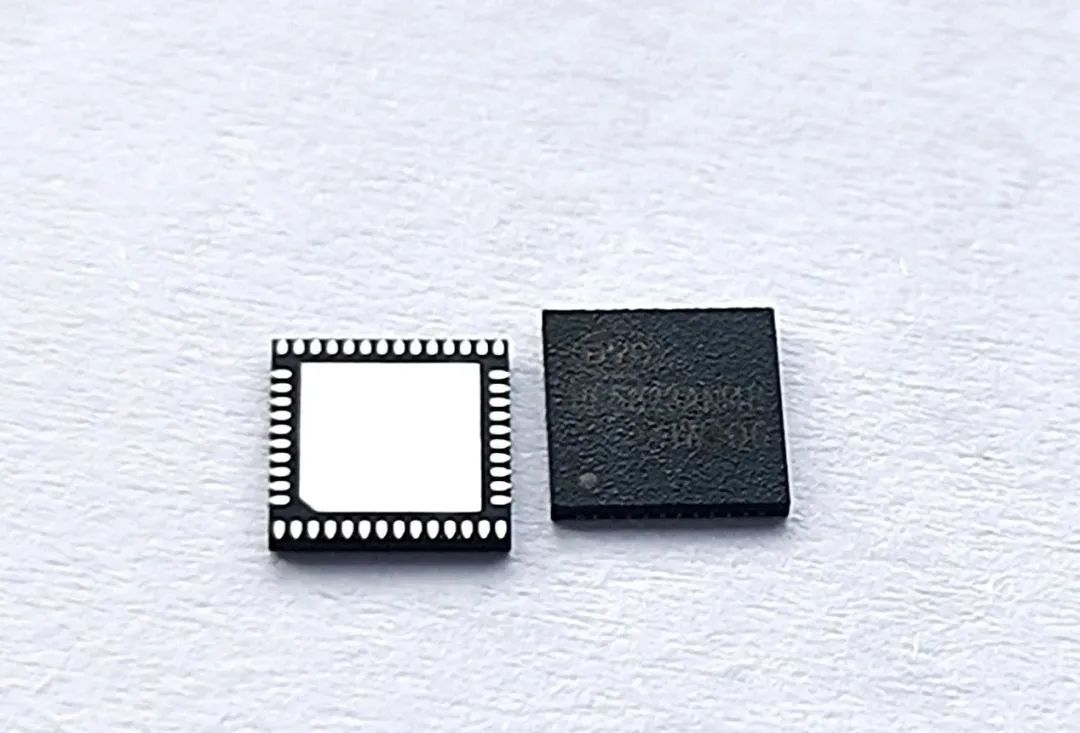

As an automaker, Byton has chosen the most difficult path—vertical integration. Whenever they can do it cheaper themselves than buying it, they choose to do it themselves, including the hardest and most tiring tasks. From the car body to the interior, from batteries to chips, they use a large amount of inexpensive labor to replace external high-efficiency technology, compressing costs to the minimum. Even overseas shipping is solved by Byton from the supply chain. Last year, Byton invested 5 billion yuan to buy 8 ships for overseas expansion.

Industry insiders marvel at Tesla’s ingenious ideas but tend to overlook the high trial-and-error costs and manpower investment behind innovation. Byton, on the other hand, has chosen the most stable and practical approach. Low labor efficiency is not a problem as long as the total cost is controllable. When sales volume goes up, they can still make a profit.

As of the first half of this year, Byton’s total number of employees has reached 631,500, but the total employee cost accounts for only 15.54% of total revenue, which was essentially the same as last year. In contrast, at the end of last year, Tesla had a total of nearly 130,000 employees. At the Tesla Shanghai factory, 19,000 people produce 500,000 cars annually, averaging 26 cars per person, while at the Byton Xi’an factory, 250,000 people produce 1 million cars annually, with an average of only 4 cars per person. Byton’s labor efficiency is even lower than that of Foxconn.

Operating so many component factories and supporting so many employees was once a huge burden for Byton. However, as the Chinese new energy market entered a period of rapid expansion, Byton became a typical example of concentrating efforts on major initiatives. They relied on accumulated expertise in technology, products, channels, and supply chains built up over more than a decade, and swiftly launched multiple models to capture the market with low prices. As sales increased, the gears of fate started turning. Vehicle manufacturing costs decreased as the entire industry scaled up, and profit margins increased. This early advantage in the industrial chain allowed Byton to customize its path to success, making it difficult for competitors to follow the same route.

Competitors also understand that Byton’s core advantage lies in cost control. However, under existing technology and production models, there is a lower limit to the cost of a car. Especially for Byton, maintaining a large workforce not only greatly increases management difficulties but also subjects them to the impact of rising labor costs. If sales decline, the component production capacity under the vertical integration model will become a huge burden.

Inability to improve labor efficiency means that Byton will always find it difficult to achieve profitability through efficiency. From the first-half financial report, Byton has increased gross profit margins on the cost side, but on the expense side, sales and management expenses have increased. This indicates that Byton is still in a phase of extensive expansion. The increase in production capacity relies on expanding the workforce, and the increase in sales relies on low prices and marketing. In the long run, all of this will limit further increases in gross profit margin.

The expansion of personnel has also brought more severe management difficulties. Several Byton employees have previously told the media that Byton’s internal management is very backward, with cumbersome work processes and no clear and effective competition mechanisms. Many employees receive salaries without working and have no desire to strive for more. They are leading a comfortable life at Byton.

In response, Byton has initiated a massive organizational restructuring to promote more independent brand operations. It has established separate departments, including the Dynasty Research Institute, the Ocean Research Institute, and the Tengshi Research Institute, and introduced competitive mechanisms such as last-place elimination. The pace of hiring is also slowing down.

Another urgent issue to address is the closed supply chain. Component subsidiaries that do not participate in market competition will gradually lose competitiveness, lagging behind in technological breakthroughs and production efficiency improvements.

Splitting the battery business unit is an example of this. Going back to 2018, Byton began planning to spin off its battery business for an IPO, which eventually led to the creation of the wholly-owned subsidiary Fudi Battery. This decision clearly stemmed from Byton’s sense of crisis. For a long time, Byton’s battery department was neck and neck with CATL. The former supplied batteries to Byton, while the latter established supply relationships with multiple automakers. Soon, independent battery maker CATL overtook Byton.

Even though Byton attempted outsourcing, subsidiaries like Fudi Battery still mainly supplied to Byton. The cost reduction pressure on Byton was continually passed down to these subsidiaries. An individual familiar with Byton told us that within Byton, the internal supply price for components is often required to be “discounted by 20%,” which is a very common figure. LatePost reported last year that Byton’s purchase price for Fudi batteries was about 10% lower than market prices, due to the need to “start from scratch in-house to unconditionally meet cost reduction targets for the entire group.”

Under this pressure, potential risks will be magnified. Even internal prices cannot be lowered indefinitely, as it will inevitably affect the quality of products. When sales decline and external supply channels cannot be opened, there is a possibility that these factory equipment and inventory capacity could become liabilities.

The above-mentioned individual stated that everyone knows about the close relationship between Byton and Fudi, and most automakers are bound to have some concerns. If the day comes when they can’t recoup their investment through their own sales, how Byton will absorb these heavy assets built under traditional models is a difficult problem.

Even greater concerns come from competitors. The Tesla Mexico factory, set to start production in 2025, may use the next-generation vehicle platform. Elon Musk stated that the production cost of the next-generation vehicle models is only half that of the Model Y, possibly around 100,000 RMB (approximately $15,700). This will seriously impact Byton’s advantage.

From 2017, when Tesla began using the integrated casting technology, single-vehicle manufacturing costs have decreased by more than 50% to date. This is a result of disruptive innovation bringing about a leap in cost reduction. This is precisely the path that Byton is not good at, and with Tesla already having a significant first-mover advantage in intelligence, even followers like Weilai are making more progress in this area.

Maintaining sales volume is the key to everything. However, the decline in market share adds some uncertainty to Byton’s prospects.

According to data from Dolphin Research, Byton’s market share dropped from 36.2% to 33.9% in the second quarter of this year, while the mainstay of its sales, the Byton Song family, saw sales decline by about 19% compared to the previous quarter. In other words, Byton is not invincible. The launch of competitive models such as the Dolphin S7, Galaxy L7, and Leap C11 will also impact Byton’s market share.

For Byton, the current glory is a long-awaited “window of opportunity” that they have been waiting for 20 years. Compared to the external applause, the emotions within Byton may be more nervous. It’s like a traveler in the desert who has been thirsty for a long time and finally encounters an oasis; they will use all their strength to drink their fill and fill all their containers with water.

Time is of the essence. On the one hand, Byton needs to maintain sales and low-cost advantages as much as possible, occupy the market as much as possible, strengthen its brand, and earn more profits. On the other hand, they need to prepare for a possible downturn and seek a way out.

At the 2022 annual performance conference, Wang Chuanfu outlined Byton’s goals for 2023, starting at 3 million vehicles and striving to double to 3.6 million vehicles. In the face of competition, speed is the top priority, followed by technology, and strategy is third. This has basically set the direction for Byton: continue to occupy market share externally, cover the low, middle, and high-end markets comprehensively, and accelerate exports. Internally, they need to build up their technical capabilities.

In addition to sweeping the market with lower-priced products, the excellent performance of Tengshi this year has also given Byton some confidence to enter the high-end market. During a conference call, Byton revealed that the profit of the Tengshi D9 is several times higher than that of entry-level vehicles. As the flagship brand of Byton’s high-end line, Tengshi has already launched D9, N7, and N8. In June of this year, Tengshi D9 even won the sales championship for MPVs. Previously, this segment had been Buick GL8’s safe haven. Such impressive sales, combined with high profits, have made Byton a lot of money.

In addition to Tengshi, Byton gave the public many imaginative teasers last year, and in the first half of this year, all these mysteries have been unveiled. At the ongoing Chengdu Auto Show, the million-yuan brand Byton U8 and Byton U9 made their debut. Among them, the pre-sale price of Byton U8 is 1.098 million RMB (approximately $172,000), making it the most expensive car in Byton’s current lineup. The more niche and personalized F brand, which focuses on off-road vehicles, is rumored to be priced between 300,000 and 400,000 RMB (approximately $47,000 to $63,000). It is understood that both the Formula Leopard 5 and Byton U8 have received a considerable number of pre-orders, and the expected future profits are also worth looking forward to.

Regarding international expansion, as early as 2021, Byton began its passenger car internationalization plan. At that time, Byton’s first pilot country was Norway, leading outsiders to speculate that Byton’s primary battleground for international expansion would be Europe for a long time. In light of this, Byton set an ambitious goal to become one of the top three electric car brands in Europe by 2030. However, according to sales data, after two years of international expansion, Byton has achieved better results in the Southeast Asian market.

In Thailand, in the first half of this year, Byton won the title of the best-selling pure electric car in Thailand for five consecutive months. As of May this year, BYD Atto has sold 9,310 units, increasing its market share to 38.6%. In countries like Singapore and Israel, Byton has also repeatedly claimed the top spot in electric car sales. In these places, cars can be sold at nearly 1 million RMB (approximately $157,000) each, adding to Byton’s profit growth and making onlookers say, “They’ve made it.”

Byton’s massive investment in research and development reflects its anxious mindset. In the first half of this year, Byton’s R&D spending increased to 14.2 billion RMB (approximately $2.2 billion), accounting for 5.48% of its total revenue. Previously, this ratio had been kept at around 4% by Byton. Last year, this figure was surprisingly high as well. In the whole of 2022, Byton’s R&D expenditure was 20.2 billion RMB (approximately $3.2 billion), which is already on par with Tesla’s 20.7 billion RMB (approximately $3.25 billion).

Byton’s increasing costs are possibly related to its accelerated push into the field of intelligence. Not long ago, Li Ke, Executive Vice President of Byton, appeared at an investor meeting and candidly admitted that Byton is currently not leading in the field of autonomous driving but will innovate in the coming years. Byton’s recent actions in the direction of intelligence have been quite remarkable. Over the past few months before the financial report was released, Han Bing, Director of Byton’s Electronic Integration Department, began leading Byton’s intelligent driving R&D team while simultaneously forming a team for designing intelligent driving chips. He stated that Byton’s R&D fleet had expanded to over 300 vehicles. Soon after, Liao Jie, former Director of Intelligent Driving R&D at Horizon Robotics, also joined Byton and assumed the position of head of Byton’s intelligent driving Shanghai team.

All of these recent moves by Byton in the field of intelligence, whether high-level statements or aggressive recruitment efforts, have surprised observers. After all, in the past, Wang Chuanfu, the Chairman and Founder of Byton, publicly expressed skepticism about autonomous driving, stating, “Autonomous driving is all nonsense. It’s just used to deceive the public. It’s a product coerced by capital and can only be used as a selling point for car manufacturers. It’s actually useless. Autonomous driving is just advanced driver assistance.” However, today, Wang Chuanfu is emphasizing “the first half is electrification, the second half is intelligence.” Considering that Byton is currently in a position where it needs to seize the window of opportunity and further expand its competitive advantage in the second half, developing autonomous driving has become a pressing necessity.

As Byton’s biggest competitor, Tesla’s profitability in the field of intelligence is indeed enviable. With the help of Full Self-Driving (FSD), even though Tesla has significantly reduced prices, it has stabilized its gross profit margin. Leveraging software for profit seems to be the mainstream route for the “second half” of the automotive industry, as car prices cannot keep decreasing indefinitely, but software can generate substantial returns.

Byton also appears eager when it comes to recruiting recent graduates. According to official data from Byton, in 2023, the company hired 31,800 recent graduates, with 80.8% of them flowing into R&D departments, making it the largest campus recruitment scale in the company’s history.

Of course, the question remains: how long will the good times last for Byton? One year? Two years? According to Wang Chuanfu’s estimation, by 2025, the market penetration rate of new energy vehicles in China will rise to 60%. At that time, car companies will face another battle.

Before that, Byton needs to seize this “golden era,” consolidate its advantages, stockpile resources, and there is still much work to be done.