“After the turmoil, Volvo and the Unanswered Questions at the Chengdu Auto Show

6 min read

“Volvo has been waiting for truly electrified products.”

In recent days, spy photos and renderings of Volvo’s new all-electric MPV model, the EM90, have started circulating online. About a week ago, Yuan Xiaolin, President and CEO of Volvo Cars Asia-Pacific, announced the launch plan for this vehicle at a media briefing ahead of the Chengdu Auto Show.

Unfortunately, due to a cold, I missed this media event.

Many industry insiders know that Quin Peiji, the former President of Volvo’s Greater China Sales Company, was also supposed to attend the Chengdu briefing.

It is said that the title of his prepared speech was to reiterate, “We learned what the new players learned in three years, what they couldn’t learn in ten years.”

While Volvo’s recent dramatic personnel changes have settled, when I see related developments, I still think of the dialogue with Quin Peiji at the Shanghai Auto Show media briefing in April this year.

It was during that briefing that Quin Peiji uttered the above-quoted famous saying about new players.

During the interview, I once asked him a question in response to his statement: “Why did new players seize the opportunity in the ‘dad’s car’ trend, while Volvo didn’t?”

He hesitated for a moment with an embarrassed expression and replied, “Traditional car companies, especially multinational ones, indeed couldn’t catch up with the pace of research and development and the front end. Most importantly, our products have to go through various testing processes before they can be launched.”

It was not a very convincing answer, but I understood that in his position at the time, he could only say that. After all, the control over product definition, development, and innovation speed was not in the hands of the Chinese side.

Now, with the enrichment of Volvo’s native all-electric platform products, I had hoped to see Quin Peiji again at the Chengdu Auto Show briefing and hear about Volvo’s evolution and any interesting changes in its attitude towards new players…

Unfortunately, there is no longer an opportunity.

However, even with Quin Peiji’s departure, Volvo still needs to answer the above question if it wants to survive in the Chinese market. So, can Volvo, after the personnel turmoil, really answer it better?

NO.1 [A clever woman can’t cook without rice]

Personnel changes are mostly to blame for sales declines.

How has Volvo performed in the Chinese market this year? Yuan Xiaolin said at the media briefing, “This year, Volvo has maintained a healthy and good state in terms of overall sales, pure electric sales, and market share.”

From January to July this year, Volvo’s cumulative sales in the Chinese market reached 92,000 units, an 8% year-on-year increase, and the market share reached 6.1%, a 0.1% year-on-year increase.

If there’s any downside to mention, it’s that Volvo’s sales of new energy vehicles in the Chinese market have been mediocre, and its electrification pace lags behind other Volvo markets.”

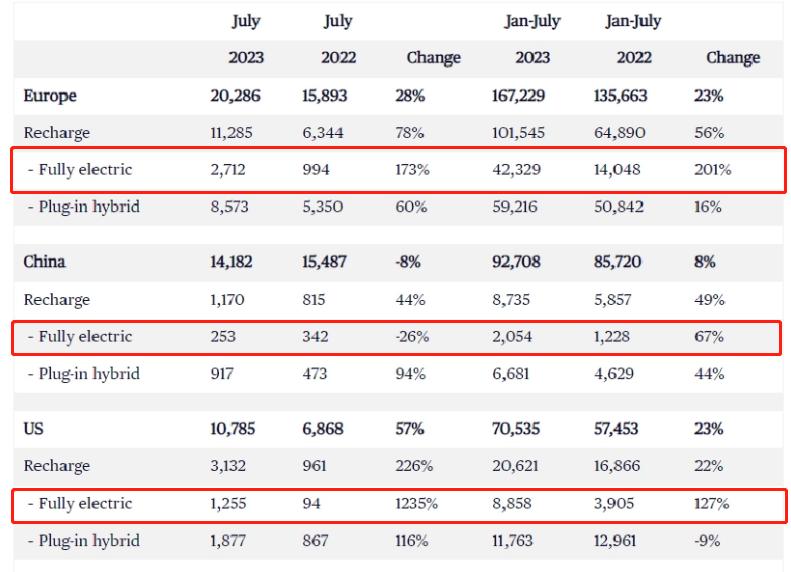

Comparison of Volvo’s New Energy Vehicle Sales in European, American, and Chinese Markets

From January to July, Volvo’s sales of new energy vehicle models in the Chinese market increased by 49%, but the sales volume was only 8,735 units.

Among them, there were 6,681 plug-in hybrid models. These models have a pure electric range of only 60-80 kilometers, slow charging speeds, and most people buy them as traditional gasoline cars, with the main benefit being green license plates and exemption from purchase taxes.

The remaining 2,054 pure electric models are distributed to less than 300 units per month on average. For a brand aspiring to achieve full electrification by 2030, this progress is indeed a cause for concern.

However, in international markets, Volvo’s electric vehicle sales tell a different story. From January to July, Volvo sold 42,300 pure electric vehicles in Europe and 8,858 in the United States.

So, why is it not selling well in the Chinese market?

Who should bear the responsibility for this? Is it the product or the marketing? Is it the Swedish side or the Chinese side?

In past interviews, Quin Peiji admitted, “The two current plug-in hybrid cars are just transitional products. Volvo has been waiting for truly electrified products.”

Volvo’s current electric cars on sale, the C40 and XC40, besides being plug-in hybrids, even lack features like voice-controlled windows, have average electric range, and are not cheap.

Selling such products well in the Chinese market is indeed challenging.

Before the arrival of “truly electrified products,” Quin Peiji made exploratory and innovative attempts in the transitional period, such as channel reform and digital capability building.

For example, streamlining existing data processes to achieve visualization and digitization from pre-sale to after-sales, and improving service levels in collaboration with dealerships.

What exactly are new players good at? Quin Peiji believes that digital capabilities and TOC (To Consumer) capabilities are most important.

Furthermore, in terms of serving new energy vehicle users, Quin Peiji believes that whether it is a direct sales model or not is not the key. “As long as standardization and digitalization are done well enough to effectively regulate dealer behavior, then the dealership model can achieve the same results as direct sales.”

Volvo, together with its dealers, has launched 37 city convenience stores nationwide, achieving profitability in 40% of stores, on par with 20% of stores. “If we count brand exposure and gasoline vehicle leads, this model has essentially been successful,” Quin Peiji said.

In the past two years or so, to promote Volvo’s electrification transformation, Quin Peiji even became the luxury brand’s marketing chief with the most frequent interactions with the media.

So, is the poor sales of Volvo’s electric cars due to a delay in good products arriving, or is the channel reform just superficial?

I believe industry insiders in the midst of a competitive automotive market may have the same answer.

NO.2 [Perplexing “De-Chinization”]

Volvo’s response to the current electrification trend in the Chinese market by transitioning from gasoline to electric is not unique. From a global perspective, the performance of such transitions in other international markets has not been as challenging as in China:

Volkswagen’s ID series, as well as Hyundai and Kia’s gasoline-to-electric transition, have been much smoother in Europe and the United States compared to China.

So, the fundamental cause of the differences in perception between China and abroad may be what is leading to a series of problems.

In previous media briefings, Quin Peiji repeatedly expressed that the understanding of electric vehicles in Europe is completely different from that in China.

“Chinese consumers believe that electric cars must be intelligent, but there is no such concept overseas. In Europe, the demand for electric cars is primarily driven by environmental concerns, and they don’t even care if it’s a gasoline-to-electric transition.”

Regarding the research and development process, Quin Peiji once joked about asking his R&D colleagues, “Why can’t you keep up with others in terms of speed? Is it because you don’t want to work overtime?”

Of course, not wanting to work overtime is not the only problem. “In our minds, electric cars can be launched first and then iterated, but they (the Swedes) believe that this does not adhere to automotive production principles, and I couldn’t convince them,” Quin Peiji said.

In addition, he also explained why he kept saying that he could learn what new players did in three years. “Many times, I was referring to our R&D; it may take them three years to learn what intelligence means.”

These expressions were actually quite straightforward. However, from the current results, the Swedish side may not want to learn from new players and may not even want to have a deeper understanding of the current situation in the Chinese market.

Otherwise, what does it mean to replace the new marketing head of Volvo China with a foreigner?

Volvo President and CEO, Lex Kerssemakers

In today’s Chinese market, it has become a leading indicator in the field of intelligent electric vehicles. Multinational companies like BBA, Toyota, Volkswagen, and others are taking practical steps to implement localization management and research and development.

In March of this year, Duan Jianjun was appointed as the President and CEO of Mercedes-Benz Sales Company, marking the first time a Chinese executive has held this position and seen as a key step in Mercedes-Benz’s localization efforts.

In the past month, both Volkswagen and Audi have entered into partnerships with XPeng Motors and SAIC Motor Corporation, respectively, using advanced Chinese electric vehicle platforms to develop new products.

In this context, Volvo’s simultaneous call for “localization” while “de-Chinization” of its management team is perplexing. It also raises concerns: Will this decision further disconnect Volvo from the Chinese market?

Or perhaps, despite being a foreigner, Lex Kerssemakers actually understands China better than Chinese executives like Quin Peiji?